Invoices Explained

In the realm of business transactions, invoices serve as vital documents facilitating the exchange of goods and services between sellers and buyers. Whether you’re a seasoned entrepreneur or just starting out, understanding the nuances of invoicing is crucial for maintaining financial integrity and fostering smooth business operations.

In this comprehensive guide, we’ll break down the essentials of invoices according to the guidelines provided by the Queensland Government.

Types of Invoices

Before diving into the specifics, it’s essential to understand the different types of invoices and their respective purposes. The two main types are:

- Regular Invoices: These are utilised by businesses not registered for Goods and Services Tax (GST). Regular invoices do not include a tax component, and it’s important not to label them as “tax invoices.”

- Tax Invoices: If your business is registered for GST, you must issue tax invoices for taxable sales. Tax invoices include the GST amount for each item sold and must adhere to specific requirements outlined by the government.

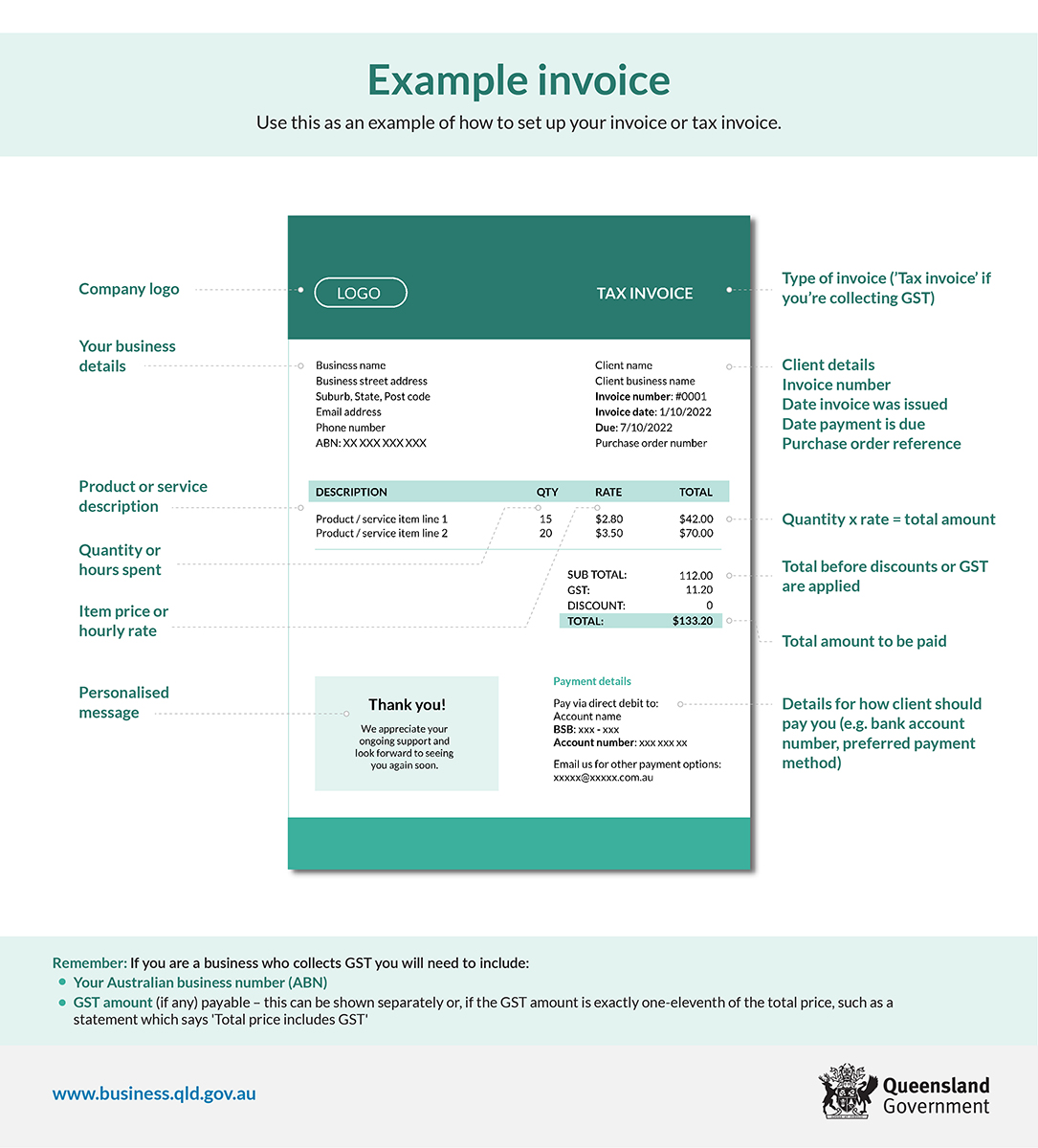

Essential Components of an Invoice

Regardless of the type, every invoice should contain certain key elements to ensure clarity, accuracy, and compliance. These include:

- Seller’s Details: Your business name or company name, along with contact information, should be clearly stated on the invoice.

- Australian Business Number (ABN): Including your ABN helps identify your business for taxation purposes.

- Invoice Issue Date: This signifies the date the invoice is issued and is crucial for tracking payment timelines.

- Description of Goods or Services: A detailed list of items or services provided, including quantity and price, helps both parties understand the transaction.

- GST Amount Payable: For tax invoices, the GST amount for each item should be clearly displayed, or a statement indicating that the total price includes GST should be included.

- Buyer’s Details: Tax invoices for sales of $1,000 or more should also include the buyer’s identity, such as their business name, company name, or ABN.

Best Practices for Invoicing

To streamline your invoicing process and ensure prompt payments, consider implementing the following best practices:

- Maintain accurate customer details to ensure invoices reach them promptly.

- Issue invoices promptly after a sale to avoid delays in payment processing.

- Clearly outline payment terms, due dates, and accepted payment methods to avoid confusion.

- Follow up with customers after sending an invoice to mitigate payment delays and resolve any disputes promptly.

- Ensure your invoices are easy to understand and comply with legal requirements to avoid potential penalties or disputes.

By adhering to these guidelines and best practices, businesses can effectively manage their invoicing processes, maintain financial transparency, and foster positive relationships with customers. Remember, invoices are not just financial documents—they’re a reflection of your professionalism and commitment to excellence in business operations.

Photo Credit: Queensland Government.

Save time and book online!