Business Structures Explained

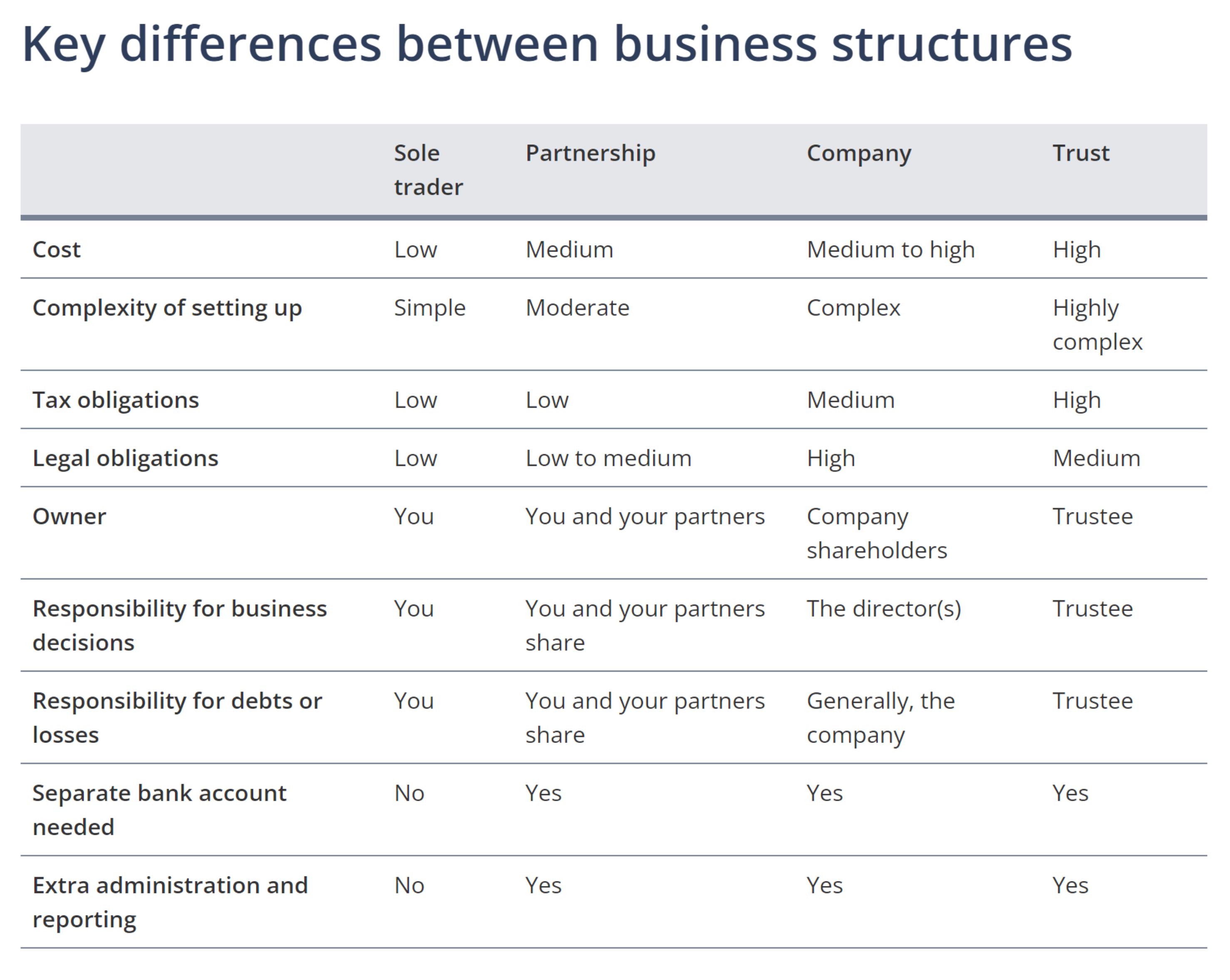

Starting a new business can be both thrilling and daunting, especially when it comes to deciding on the right business structure. Each type of structure has its own set of advantages, disadvantages, and legal implications. In this guide, we’ll break down the four main business structures – sole trader, partnership, trust, and company – to help you make an informed decision.

1. Sole Trader

A sole trader is the simplest form of business structure, where you, as an individual, operate the business. Here are the key elements to consider:

- Simplicity: Setting up and operating as a sole trader is straightforward and inexpensive.

- Control: You have full control over business decisions and assets.

- Taxation: The taxable income of the business is yours, therefore you will personally pay tax on all profit of the business.

- Liability: You’re personally responsible for all debts and losses incurred by the business.

2. Partnership

A partnership involves two or more individuals sharing ownership of the business. Key elements include:

- Ease of Setup: Partnerships are relatively easy and inexpensive to establish.

- Shared Control: Partners share management responsibilities and decision-making.

- Taxation: Partnerships themselves don’t pay income tax; instead, partners pay tax on their share of profits. Partnerships do need to lodge a tax return though.

- Liability: In a general partnership, all partners have unlimited liability for the business’s debts.

3. Trust

A trust involves a trustee managing the business for the benefit of beneficiaries. Key elements of a trust structure include:

- Complexity: Setting up and operating a trust can be complex and costly.

- Asset Protection: Trusts offer asset protection for beneficiaries.

- Formalities: Trusts require a formal trust deed outlining operations and administrative tasks.

- Liability: The trustee is legally responsible for the trust’s operations.

- Taxation: The taxable income of the trust must be distributed to beneficiaries every year who will include this income in their tax return and pay tax on the income personally or the trustee will be taxed on the taxable income at 47%.

4. Company

A company is a separate legal entity from its owners (shareholders). Here’s what you need to know about setting up a company:

- Legal Entity: A company is a distinct legal entity, offering limited liability to shareholders.

- Complexity: Companies are more complex to establish and maintain compared to other structures.

- Capital Access: Companies have wider access to capital through shareholders.

- Taxation: Companies pay tax on their profits, and directors must fulfill various legal and reporting obligations.

Tax and Legal Obligations

Regardless of the business structure chosen, there are tax and legal obligations to fulfill. These include:

– Registering for goods and services tax (GST) if revenue is $75,000 or over per year.

– Keeping accurate financial records.

– Complying with all obligations under relevant laws and regulations.

In conclusion, selecting the right business structure is crucial for the success and sustainability of your venture. Consider factors such as liability, taxation, complexity, and your long-term business goals before making a decision.

Photo Credit: Commonwealth Government of Australia.

Save time and book online!